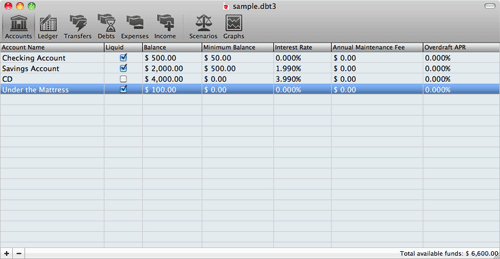

Working with Accounts

Accounts are the starting point of working with Debtinator. You've gotta put your money somewhere, and Debtinator needs to know about it. Even if you're just stuffing it under your mattress and paying cash for everything, this is how you let Debtinator know about it. Usually these are going to be accounts you have at your bank, but that's not a requirement.

So any pool of money that is going to factor into your debt repayment strategy should go in here. And keep in mind that that includes money you can't use for debt repayment! For example, you may have a 401(k) that's being funded out of your Checking account. If you add it in here, you can have Debtinator keep track of the money moving in there for you, without you needing to worry about maintaining it yourself.

Accounts are very easy to work with, there are only a couple of fields to fill in.

- Account name - Easy. This is just the name of the bank account involved. Checking, Savings, Coffee Can in the backyard, etc.

- Liquid - a "liquid" account is one that you can withdraw money from. If it's not liquid, you can't schedule events against it or withdraw money from it. Most of your accounts will be liquid - you can always take money out of checking or dig up that coffee can. Some will not be liquid. Maybe your savings account has fees for withdrawals, so it's not. Or your 401(k) is something that you funnel money into, but never withdraw.

- Balance - The current bank account balance. If you edit this field directly, then Debtinator will automatically add a "Manual Adjustment" transaction on the Ledger Pane

- Minimum Balance - the minimum amount of money you want to keep in this bank account. By default, Debtinator will always use as much money as it can find to

pay towards your debts, which means that it'll pay down your bank account to $0 whenever it can. But you may want to hold onto a buffer in the bank to cover unexpected

expenses. This allows you to. Debtinator will always ensure that at least your minimum balance remains in the account. Note that you can also set aside money by using

a budget which you set up on the Ledger pane.

European users that can safely withdraw their bank accounts past $0 without incurring large fines (like we do in the US) can set this value to a negative number.

- Interest - If you're lucky, your bank pays you interest for keeping money in the bank. Fill it in here. Interest will be scheduled to be applied on the first of every month.

- Annual Maintenance - Of course, if you're unlucky, you have to pay the bank to maintain your account. Fill that in here. This fee will be broken out into monthly installments, also due on the first of the month.

- Overdraft APR - This is mainly for users in Europe and Canada and doesn't really apply to the United States. In the US, if your balance drops below $0, you usually have to pay

massively huge fines for dropping below $0, fines for having a negative balance, fines for the bank cashing your check anyway, and so on. So we don't want to ever drop below $0 (and Debtinator

will ensure that you don't).

But in Europe, many bank accounts can be withdrawn past $0 and at that point you just start paying interest on the money you've borrowed. It's basically a checking account and credit card combined into one.

If your account operates that way and you can overdraft for an interest penalty, then fill that in here. Otherwise, just leave it as $0.

To work with accounts:

- Click on the accounts pane in the toolbar.

- Click the '+' in the lower left to add a new account, or the '-' to delete the selected account.

- Fill in the account's information.

See also